Net Amount (excluding VAT):

VAT (at 20%):

Gross Amount (including VAT):

Calculation based on:

Free VAT Calculator UK 2025

With our free online VAT calculator UK, you can add VAT to a net amount entered or remove VAT from any gross amount entered. Calculator’s default VAT Rate is 20%, which is the UK standard VAT rate. However, you can calculate any VAT rate like reduced VAT rates etc.

- Our online VAT calculator is for calculating VAT rates in the UK

- The Currency of VAT is the pound Sterling

- While the Default VAT rate is: 20%

How to Use Our Online VAT Calculator UK

Looking for Expert SEO Services?

Boost your accounting business online with tailored SEO strategies.

Features of Our Online VAT Calculator UK

Round Off Figures

Our online tool rounds figures to the nearest whole number or the decimal place below it. This way, you can calculate your tax amounts without worrying about rounding off the digits in your VAT return.

Flexible VAT Rates

You can calculate not only the standard UK VAT rates but also any tax rate. You can manually enter any other tax rate. For example, reduced VAT etc.

What is VAT?

VAT is for Value Added Tax. It’s an indirect tax that is paid by the end consumer. It is applied to the sold goods and services and is collected by HMRC (His Majesty’s Revenue and Customs). Every UK-based company whose turnover for a year exceeds more than £90,000, is required to apply for VAT registration.

| Reduced VAT rate items 5% | Zero-rated items | VAT exempted items |

| Residential conversions | Books and newspapers | Some types of education & training |

| Children’s car seats | Children’s clothing and shoes | charities |

| Women’s sanitary products | public transport | Betting and gaming |

| Domestic consumption fuel & power | Export goods | postage stamps |

| Energy saving installation | Motorcycle helmets | Insurance |

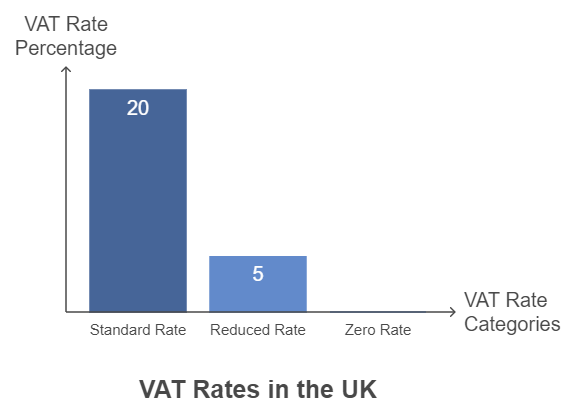

VAT Rates in UK

- UK Standard VAT Rate is 20%. Mostly this rate is charged on goods and services

- The reduced VAT Rate is 5%, and it’s for specific items such as women’s and kid’s items.

- Zero VAT Rates are applied mostly on exports, books, etc.

Get Your VAT Number

In the UK, VAT is collected from all the businesses that are eligible for registration for VAT i-e their annual turnover exceeds £90,000. Before 1st April 2024, this limit was £85,000. This tax is collected on behalf of HMRC. After registration, each company gets its VAT registration number to claim VAT that has been paid earlier on their purchases on their VAT return.

How to Work out VAT?

Basically there are two formulas to calculate VAT. Adding VAT formula and Removing VAT formula. Here is how to calculate UK VAT.

Adding VAT

- Before calculating the VAT formula, find out the VAT rate applicable to those specific goods or services for which we are going to calculate VAT.

- Then convert the VAT rate into decimal form by dividing the tax rate by 100. For example, if the applicable tax rate is 20%, then its decimal form will be 20/100= 0.20

- You have to determine the gross amount of products from the net amount. For adding VAT, a net amount means price excluding VAT.

- Calculate the Value Added Tax amount by multiplying the net amount with a decimal form of the VAT rate.

- Now Add this VAT amount to the net amount of product to get the gross amount, a price including VAT.

VAT amount = Net price of products x VAT rate in decimal form

For example, if the net amount of goods or services is £400, and the applicable VAT rate is 20%.

VAT amount = £400 x 0.20 = £80

Gross Amount = £400 + £80 = £480(VAT inclusive price)

Removing VAT

- Determine which VAT is applicable; standard or reduced tax rate.

- For removing VAT formulas with VAT calculator UK, you get the gross amount. It means the tax is added to the price.

- In this case, you have to find out the net price of products from the gross price. The net amount (amount before VAT) is calculated by dividing the gross amount by one added by the decimal form of the VAT rate.

- By subtracting the net amount from the gross amount, we get the VAT amount.

Net Price (price exclusive VAT) = Gross amount/(1+ Tax rate in decimal form)

VAT Amount = Gross Price – Net Price

For example, if the gross price of goods or services is £450, and the Tax rate is 20%(a decimal form of 20% is .20)

Net amount = £450/(1+.20) = £450/1.20 = £375(VAT exclusive price )

VAT amount = Gross-Net =£450-£375= £75

FAQs About VAT Calculator UK

Conclusion

With our VAT calculator UK, you can calculate the gross amount of products by entering the net price ( VAT exclusive price) in the amount field and then clicking the Add VAT button. Similarly, enter the gross amount ( VAT inclusive price) and click the remove VAT button, you can find the net price of the product.

The default tax rate is set to 20%, but you can manually enter the tax rate other than the standard VAT rate. For accuracy, our online Tax calculator tells you the amount after rounding it off to the nearest whole number. Remember, this tax calculator is for calculating the UK VAT rates.